More Than 1 Out Of Every 7 German Pharmacies Offers Medical Cannabis

More Than 1 Out Of Every 7 German Pharmacies Offers Medical Cannabis

Germany has served as the largest legal medical cannabis market in Europe for several years, with cannabis pharmacies being the foundation of Germany’s emerging industry. Legal medical cannabis sales first launched in German pharmacies in 2017.

Since the launch of initial sales, safe access to medical cannabis via Germany’s pharmacies has increased dramatically, as demonstrated by statistics that were included in the German Cannabis Business Association’s (BvCW) most recent newsletter.

“Patients can order cannabis online with a private prescription and have it delivered to their home. Nationwide, around 2,500 of the 17,000 pharmacies now offer medical cannabis,” BvCW stated (translated from German to English). “The industry’s revenue is now estimated at around half a billion euros.”

Having recently traveled to Berlin, Germany, for the International Cannabis Business Conference Week, I witnessed the level of excitement and interest that has engulfed Germany’s emerging medical cannabis industry. Industry members worldwide are clamoring to try to get into the growing German market, and to a lesser extent, other European markets.

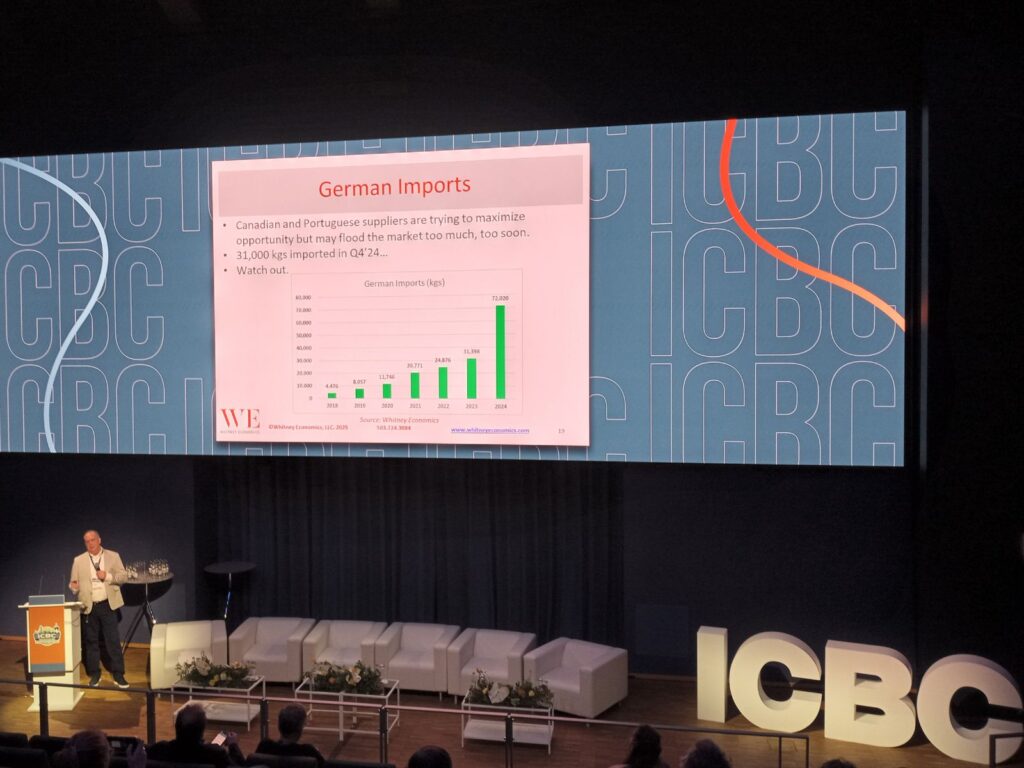

Leading international cannabis economist Beau Whitney, founder of Whitney Economics, provided a keynote presentation at the International Cannabis Business Conference in which he highlighted cannabis product import data that helps quantify the level of international interest in Germany’s market:

As large as Germany’s medical cannabis industry is becoming, it is still in the early stages by many measures. Consider the fact that many medical cannabis product sales found in other legal markets, most notably edibles, are not currently permitted in Germany. Only cannabis flower and extracts are being sold in the legal German market.

Cannabis edibles are particularly popular with patients and consumers who would otherwise not consume cannabis. Many consumers and patients prefer edibles and other consumables because they are smokeless cannabis delivery methods.

Typically, when you read about ‘increases in cannabis consumption’ following cannabis policy reform enactment, the increase is due to older individuals who have either never consumed cannabis or are coming back to it after a long hiatus, and their cannabis products of choice are often edibles, drinks, and/or topicals.

To get an idea of what Germany’s industry is currently missing out on when it comes to product variety and availability, consider sales data from the United States. According to a recent article by Honeysuckle Magazine, only 41% of products sold in the U.S. on the cannabis holiday April 20th were for cannabis flower.

Vape products were responsible for 27% of national sales on 4/20, edibles made up 14% of sales, pre-rolls were 10% of sales, and extracts were 6% of sales. The remaining sales were presumably for topical products.

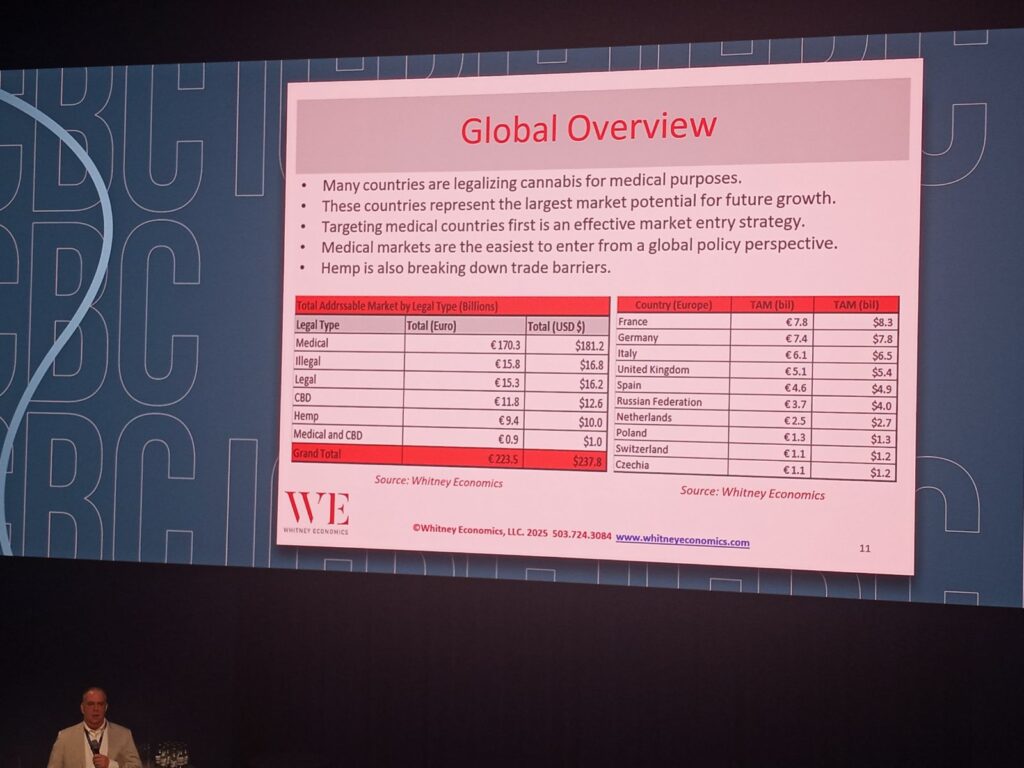

Below is another data chart that Mr. Whitney shared during his presentation in Berlin, which contains the total addressable market for Germany and other European markets. As you can see, the previously cited half a billion euro estimation for Germany’s current industry, referenced earlier in this article, is a mere fraction of the true potential of Germany’s cannabis industry:

One of the professed goals of German cannabis policy modernization efforts is to sufficiently combat the nation’s unregulated cannabis market to boost public health outcomes. The only way that goal will be achieved is by lawmakers in Europe’s largest market instituting a robust commerce system that allows consumers and patients to legally access the cannabis products that they want to purchase.

Until that happens, the unregulated market in Germany will continue to thrive, the nation will continue to miss out on the economic boost that a sufficient legal market yields, and public health outcomes will pay the price, with consumers and patients making their purchases of untested products from unregulated sources.

One thing is for sure – consumers and patients will not stop consuming cannabis just because such activity is prohibited. History is very clear on that. Lawmakers and regulators in Germany and throughout Europe would be wise to recognize that reality and to pursue sensible, balanced public policies.

Share article

Share article

Join Our Awesome Community

Join Our Awesome Community

Join Our Awesome

Community

Get all the latest industry news

delivered to your inbox