Cannabis Safe Payment Act Could Aid California Tax Collections

Cannabis Safe Payment Act Could Aid California Tax Collections

One of the biggest problems in the cannabis industry both old and new, is the issue of money. By that, I mean dealing with large amounts of marijuana inevitably means dealing with large amounts of cash. In a world without regulation, theft and bad business deals have made for a dangerous and unpredictable environment. Ridding communities of underground and rogue policing, and reducing the associated violence of the black market is one of the biggest selling points to ending prohibition. Dealing with large sums of cash creates an extremely risky situation. Unfortunately, until federal banking laws change, this is the reality that cannabis businesses are forced to deal with. But in the meantime, the legal marijuana industry still must comply with local regulatory oversight – and that means paying taxes.

Some California lawmakers are hoping to ameliorate at least some of the problem of the cash cannabis economy – and they want to ensure the state is getting its taxes. Currently, without the aid of electronic transactions, many cannabis businesses are forced to drive several hours across the state to Sacramento with enormous sums of cash to give their allocated share to the state Board of Equalization. With the new bill recently introduced by state Sens. Scott Wiener, D-San Francisco, and Toni Atkins, D-San Diego, the places where those taxes can be paid in cash would increase significantly, easing the burden of business owners and creating a more efficient system of tax collection.

Nate Bradley, executive director of the California Cannabis Industry Association, said the banking issue remains a top concern, but providing more areas in the state where cash tax payments can be made “will help to reduce the risks and ensure that the state is paid the money it is owed.”The Board of Equalization — which is the state’s tax collector — takes in around $40 million in sales taxes each year from the medical marijuana industry. In the case of large dispensaries, tax payments made in cash can be upwards of hundreds of thousands of dollars.Under the bill — which is being called the Cannabis Safe Payment Act — local governments could choose to participate with approval from their county board of supervisors and their local tax collector so that area dispensaries have a nearby option for making their tax payments.

Following the passage of Prop 64, wheels have been set in motion to create a new and better framework for legal cannabis regulation. There is no doubt that many changes and political fixes will be occurring over the next year to address problems associated with the legal market. Be sure to join us with the International Cannabis Business Conference in San Francisco on February 17th for this important, one-day only event to learn the latest goings-on in this exciting new market of adult legal cannabis.

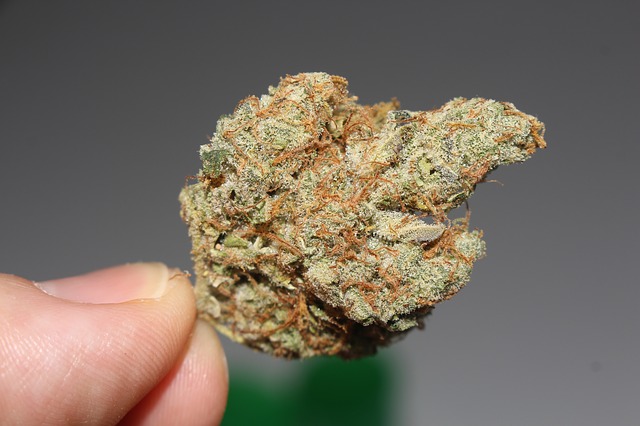

Featured photo courtesy of: www.SeniorLiving.Org

Share article

Share article

Join Our Awesome Community

Get all the latest industry news delivered to your inbox

Join Our Awesome Community

Get all the latest industry news delivered to your inbox

Join Our Awesome

Community

Get all the latest industry news

delivered to your inbox

RELATED NEWS

THANKS FOR SUBSCRIBING!

Welcome to our community! From now on, you’ll get insider updates, fresh ideas, and industry news straight to your inbox.

THANKS FOR SUBSCRIBING!

Welcome to our community! From now on, you’ll get insider updates, fresh ideas, and industry news straight to your inbox.